A Quick Rundown

DISCLAIMER: All views and ideas expressed on this site are my own and do not reflect the views of my employer, past, present or future. The information provided on this website is for general informational purposes only and is not intended to be taken as financial advice. Always consult a licensed financial advisor before making any financial decisions

Now that we’ve had a couple of month breather from the events of the last few months, I thought it was a good time to sit back and truly reflect on what is happening.

The collapse of the S’es

Silicon Valley Bank

Silicon Valley Bank (SVB) was established in 1983 as a bank that serves the very unique needs of tech companies in Silicon Valley. From then, it grew to become the 16thbiggest bank in the US with $209bn in assets by the end of 2022 according to the FDIC (we will come back to them later). All is great for SVB right? They were financing nearly half of US venture-backed tech and health firms, had $209bn in assets, and around $175.4bn in deposits! What could possibly go wrong?

Like most banks, SVB invested in US treasuries (US T) and Mortgage-Backed Securities (MBS), to profit off otherwise stagnant customer deposits. Both US T’s and MBS’s are considered safe haven places to park your money, so how is that bad?

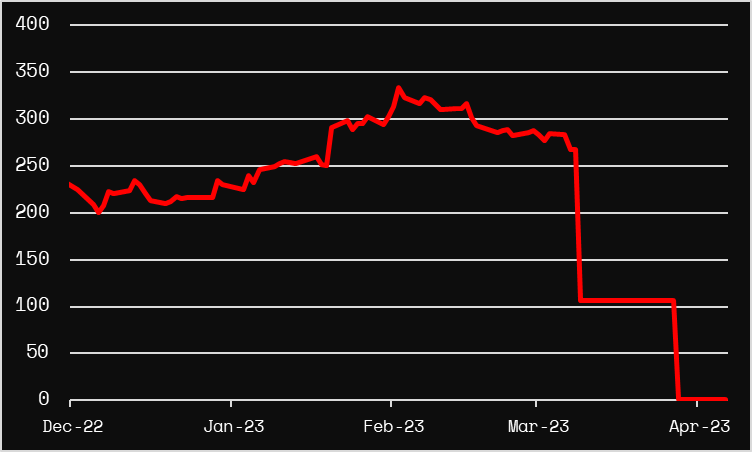

While trying to combat inflation, the US Fed raised rates from 0.5% in early 2022 to the current 5%. Sadly for SVB, when interest rates are increased, the value of older, lower coupon bonds heavily drops as people move their money to higher yielding “risk-free” bonds. This means that SVB’s bond portfolio has now heavily depreciated to the point of possible insolvency. Well, it can’t be that bad right? Just raise some capital! SVB decided to do a public capital raising of $1.75bn USD. This sent depositors in a frenzy as many believed the bank was insolvent. On March 7th alone, the price of the stock slid 60% right after the capital raise announcement. In hindsight, this capital raise should have been private, and as an SVB Insider told CNN:

“You’re in business for 40 years and you are telling me you can’t raise $2 billion privately? Get on a jet and fly to Kuwait like everyone else and give them control of one-third of the bank.”

I could not have said it any better Mr. Insider.

One thing that not many people talk about is duration risk. Interest Rate risk was the main reason for the collapse of SVB, but duration risk was also a factor. Banks should (and mostly do) match the duration of their liabilities with their assets, and putting most of your assets into tenors as long as 10-year US Ts and MBS’s are definitely way too long.

So now SVB has A) a deteriorated bond portfolio and B) massive drop in stock price. What next?

The FDIC Appears! On March 8th, SVB was shut down by Californian regulators and placed under the control of the FDIC. Yay! The FDIC was here to save the day, right? Well, SVB, unlike personal banks has lots of clients, if not most, with large accounts, way over the FDIC $250,000 limit. So, who’s going to come and save the day? First Citizens Bank (FCB)! FCB will purchase $72bn of SVB’s assets for $16.5bn (pretty neat discount, wonder how many coupons they used!), and the rest of the assets worth around $90bn, will be under the control of the FDIC.

Summary of this story is the reason I always put “risk-free” assets in quotes when mentioning US Treasuries. While they are very safe (the current debt ceiling fiasco doesn’t not help, but that is a story for another day), they are still under interest rate risk, and how this “risk-free” asset destroyed the asset-liability management of this bank that otherwise would still be holding VC-backed companies so very close to its heart.

Signature Bank

Though not as interesting, the story of Signature Bank (SB) is one we should know about. SB was a bank in New York that catered mostly to middle-market companies, but mostly legal, real estate, and cryptocurrency companies (Yes, the C word is bolded). It was considered the 19th largest bank in the US with assets worth $110bn and deposits of $88.5bn. They also had an FDIC-insured blockchain digital payments solution called Signet. Now what’s the problem with Signet? It required a minimum account balance of $250,000, and what’s the FDIC limit again? (oops)

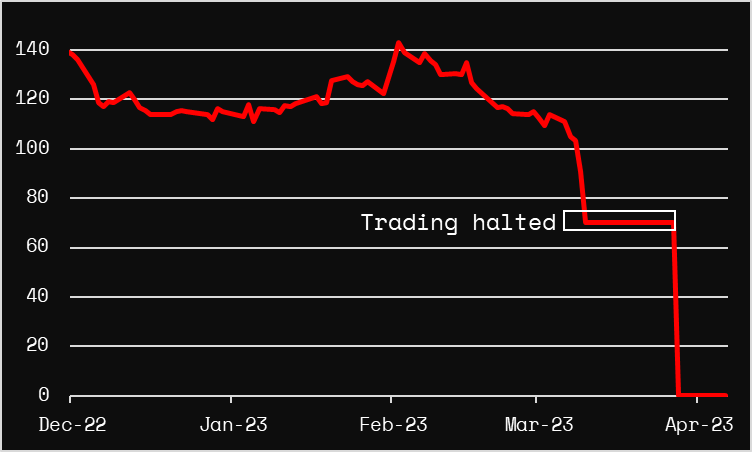

So, what went wrong? Well on the 6th of December Signature made an announcement at a Goldman Sachs conference where SB publicized its intention to get rid of $8bn of its 10bn$ worth of deposits from the crypto sector (the crypto sector was going through a very hard time at this time, but I’ll let you make you own opinion on FTX). That said, this announcement wasn’t that bad, and didn’t give people many scares. What really went wrong was on March 10th of this year, when SVB was shut down, the fear of contagion hit Signature Bank causing a landslide in SB’s stock price, dropping from 90$ on the 9th of March to $0.13(yes, 13 cents) on the 28th of March.

On the 12thof March the NY DFS took over Signature Bank and passed it to the FDIC. After, it was announced that Flagstar Bank would take over nearly all of SB’s assets leaving $60bn under FDIC control.

Silvergate Bank

Silvergate bank, founded in 1988, was one of the few banks in the US that actually provides financial services to Cryptocurrency firms (oh no, the C word again). It was known for being very innovative being one of the first Banks with an API for open banking (I wish more banks around the world had this)

All was going great for Silvergate, with big investment companies like Blackrock announcing a 7% stake in the bank. This was of course, until Silvergate warned the SEC of it’s intention to delay the annual 10k along with seriously evaluating it’s ability to even continue operation. Let’s slow down for a second, how did Silvergate go from one of the golden children of mid-size banks to imminent collapse? 3 letters

F T X

In the wake of the bankruptcy of FTX, and after reporting a $1bn loss in Q4 of 2022 alone, a run on Silvergate happened, leading to its inability to keep operating. Silvergate was also going through some litigious problems from it’s possible role in FTX’s practices, along with the fact that the bank lacks the required compliance procedures needed to detect money laundering. The bank issued a statement announcing, “an orderly wind down of Bank operations” and put a plan to fully repay all deposits.

Ok we got the US banks out of the way, but that’s got to be the worst of it right?

The collapse of the 167-year-old Swiss lending giant.

Credit Suisse (CS) is (was?) a financial services giant operating in over 50 countries and employing around 50,000 people. When the good old saying “too big to fail” comes up, Credit Suisse is definitely one I think of. It had a very strong reputation in the industry despite a slurry of scandals from knowingly providing services to dictators (and giving them fake names), to destroying evidence when under investigation, to breaching US sanctions, to Tax evasion, to helping cartels launder their drug money (am I allowed to use that many to’s in one sentence?).

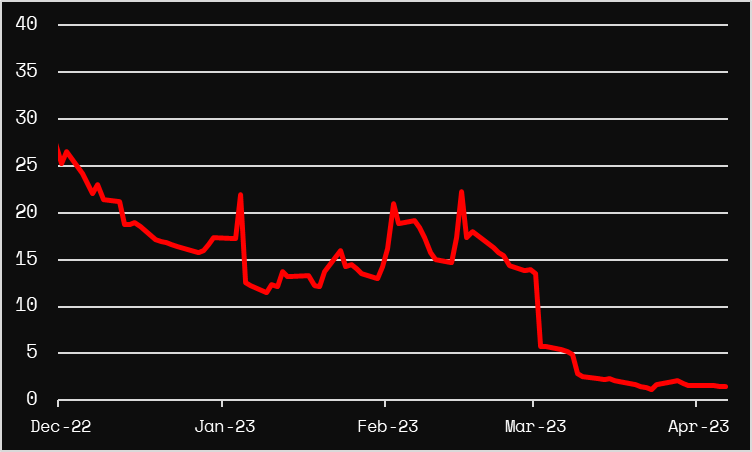

Scandals aside, the beginning of the end of CS was in 2021, when CS announced a multi-billion dollar loss due to the collapse of Archegos and Greensill Capital, but its ok! CS brought in Antonio Horta-Osorio to fix the mega-lender, but unluckily for CS he resigned only 8 months after for breaching COVID-19 rules (seriously?). In January 2022, CS replaced Antonio with Ulrich Koerner who was a restructuring expert. As an ex-CS employee, there were some optimists out there thinking there is light at the end of the tunnel for CS, but for the majority, this was around the time rumors were spreading around that CS was looking at nothing but doomsday. This, as the theme of this article, sent customers into a run on the bank.

CS in February of 2023 announced that clients pulled a total of CHF110bn in Q4 of 2022, while also announcing a loss of CHF7.29bn, the biggest annual loss (ever.). CS even tried to tap into some GCC money (recurring theme nowadays) by asking its biggest backer, Saudi National Bank, which was very publicly turned down.

Lets set the stage quickly, decades of scandals, billions in losses, two “saviors” left the firm, a nearly 75% YTD slide in stock prices, and the biggest backer refusing to help you raise some capital, what to do now? Beg the central bank! It worked! The Swiss Central Bank (SCB) agreed to give CS a $54bn lifeline worth of liquidity. But will CS actually use it and bounce back to its glorious days? Of course not! UBS came in on the 19th of march and bought CS for pennies on the Swiss Franc (get it?) at CHF 0.74 per share. For context, CS was trading at CHF2.9 at the beginning of the year, with a 52-week high of CHF7.

Lessons Learned

So, what lessons did we learn here? The biggest lesson is that the banking system is still fragile, and even small-scale failures could cause massive ripple effects. Secondly, risk management needs to be TRULY active. A bank collapsing due to having too much money in US treasuries when it had over a year to save face is horrible. Also, diversification in not only what you invest in, but also who you accept deposits from. Having a big portion of your deposits from one specific industry will heavily expose the bank to troubles within the industry, especially if this unnamed industry is majorly unregulated, riddled with scams, and heavily impacted by the tweets of a few people(remember the C word from earlier?).

One thing I wanted to close with in regards to the topic of banks was the role of credit rating agencies in all of this. An unnamed credit rating agency (one of the big 3) had an extremely high rating on SVB, but on March 8th, 2 days before the collapse, downgraded them to a lesser rating but still investment grade! On March 10th, when the collapse was extremely public, it downgraded the bank to to heavily below investment grade. As much as there is regulation on financial service providers, there needs to be some sort of oversight on credit rating agencies, making sure they’re actually doing their due diligence when it comes to credit rating, because it seems the finance community on twitter was more aware of the situation than the rating agencies whose sole job is to leave no stone unturned when rating banks and other firms.