The Digital Dilemma: Money Makeover or Monetary Mayhem?

DISCLAIMER: All views and ideas expressed on this site are my own and do not reflect the views of my employer, past, present or future. The information provided on this website is for general informational purposes only and is not intended to be taken as financial advice. Always consult a licensed financial advisor before making any financial decisions

In an epoch of digital transformation, no bigger transformation can be imagined than reimagining fiat currency. In a world where pocket change is becoming an ancient relic, a new (an/pro)tagonist has taken center stage: Central Bank Digital Currencies (CBDCs).

It feels like not too long ago when cr*pto (the C word) currencies where the wild wild west of the financial system, but now, central banks are deciding to join the game. As we step into this realm where algorithms meet monetary policy, it’s important to lift the curtain on CBDCs and examine their advantages and pitfalls. From the intricacies of implementation to the broader macroeconomic repercussions, today we try to grasp the significance of CBDCs within our modern financial system.

What are they?

CBDCs are a virtual form of a nation’s legal tender, which is directly issued, and regulated by the respective central bank. The biggest difference between Cr**to (can’t say it) and CBDCs is the backing, regulation and authority of the central bank, which issues them as an evolution(depending on who you ask) to conventional currency.

Benefits:

Efficiency

CBDCs have the potential of streamlining payments making the financial system quicker and more intuitive. Though some might not know this, Bank transfers are a very complicated net of relationship accounts called correspondent banking.

Correspondent banking refer to arrangements between two FIs, usually operating in different countries. One bank (the correspondent bank) provides financial services to the other bank (respondent), and vice versa. This involves Banks opening accounts in other banks, and vice versa to facilitate the process of transfers, without physical money bags being lugged over borders.

Let’s say you are in the UK and bank with Bank A (UK) and want to convert your GBP to USD. This is the steps it would usually take.

- Nostro Account (Bank A - UK):

- Bank A (UK) maintains a nostro account with Bank B (USA) in US dollars. This means that Bank A has a US dollar account with Bank B, held in the USA.

- The purpose of the nostro account is to facilitate Bank A's transactions involving US dollars. Bank A can use this account to send, receive, and manage USD transactions.

- Vostro Account (Bank B - USA):

- Bank B (USA) maintains a vostro account with Bank A (UK) in GBP. This vostro account represents Bank A's account with Bank B in British pounds.

- The vostro account enables Bank B to conduct GBP transactions and manage its GBP funds efficiently through Bank A's UK-based account.

- GBP to USD Conversion Process:

- A client wants to convert a certain amount of GBP into USD.

- The client's account is with Bank A (UK), and they approach the bank to initiate the conversion.

- Transaction Steps:

- The client instructs Bank A to convert a specific amount of GBP into USD.

- Bank A processes the client's request and debits the client's GBP account for the converted amount.

- Bank A sends an instruction to Bank B (USA) to credit the equivalent amount in USD to Bank A's nostro account with Bank B.

- Bank B (USA) executes the transaction by crediting the specified amount of USD to Bank A's nostro account.

- Interbank Reconciliation:

- Both Bank A and Bank B reconcile their nostro and vostro accounts to ensure the accuracy of balances.

- Bank A confirms that its nostro account with Bank B reflects the correct amount of USD received from the GBP to USD conversion.

- Bank B ensures that its vostro account with Bank A reflects the proper GBP amount after the conversion.

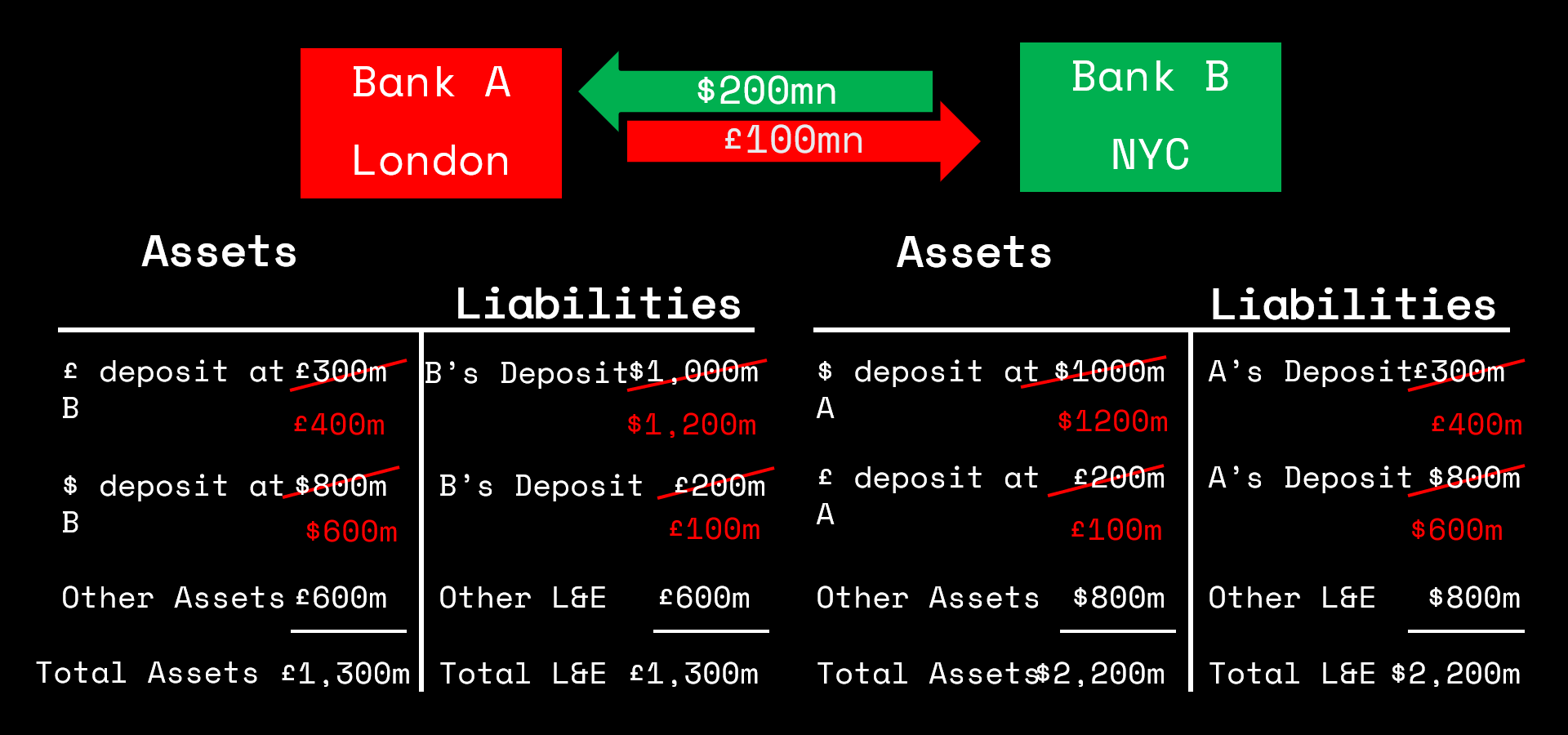

For illustration purposes, assume buying £100mn for $200mn

Now imagine a messy net of these transactions and call it the swift network, which is way too slow to handle the sheer volume of cross border transactions in our day and age.

CBDCs can potentially solve this issue. CBDCs, due to their digital nature, can be processed instantly, regardless of location, without the need for intermediaries, counterparties, clearing houses, or settlement processes. Since this is all digital, there is 24/7 accessibility, with no need to worry about banking hours, banking holidays, or weekends.

Transparency

CBDCs can also limit counterparty risk. Assuming CBDC transactions would be based on blockchain technology, with a public ledger, the transparency of blockchain records enhances trust in counter parties, and nearly completely mitigates the risk of fraud, or contract disputes. In addition to this, this transparency streamlines auditing process, which reduces the likelihood of financial fraud, and makes it much easier to spot.

the Final advantage of CBDCs, before we move to the negatives, is real time data. Since these transactions are happening digitally, without going through intermediaries, transactions will generate data in real time that help central banks, and people within the finance industry, monitor economic activity and make more informed decisions with this data. This is especially crucial for central banks who NEED extremely clear data to make decisions regarding monetary policy.

Negatives:

Privacy

Even though transparency was just mentioned as a benefit to CBDCs it can also be a negative. The digital nature of CBDCs does raise concerns over privacy infringement. Mass surveillance will now reach everyone’s pockets, with governments knowing exactly what you are buying, and who you’re transferring money to. As mentioned earlier, this is a double-edged sword. While it can provide governments with better tools to combat financial malpractice, it also provides the same governments with a brand-new database to profile and track people.

As with all digital products and services, CBDCs will also be susceptible to cybersecurity threats. A compromise of the CBDC system will wreak havoc through the global financial system assuming international integration into CBDCs. Even if it is a local attack, this cyberattack could heavily compromise the integrity of the currency, adding another layer of unneeded complexity into the global economic system.

Adoption

Even with the implementation of CBDCs, due to their digital nature, their adoption will be hard. Looking at it from the retail level, not everyone is tech-savvy enough to make transactions on their bank apps, let alone all your money being digital.

At the corporate level, new collections systems, policies and methods must be implemented. This change will be capex intensive and will need retraining for all employees across the board.

This disruption will impact us globally. As we are in a heavily globalized economy, disruptions within one country will send waves through the economies of others. A saying of unknown origin comes to mind when talking about the globalized economy: “If America sneezes, the whole world gets sick” A great example of this is the Russia-Ukraine war where global supply chains were hit heavily due to physical restrictions and sanctions.

Disruption of the Traditional Banking System:

The implementation of CBDCs would completely circumvent the need for banks. CBDCs would provide direct access to the central bank, reducing, or even completely getting rid of financial intermediaries like banks for basic financial services. Deposits and lending could happen completely through the central bank, making it more of a commercial bank, rather than a central bank.

Traditional banks have a massive network of physical brick and mortar branches, which, CBDCS would completely disrupt. There will be no need for these physical branches if all transactions could be done online, on a website or in-app.

Even if we assume a world where CBDCs and traditional fiat coexist, the digital nature of CBDCs would provide lower transactions costs when compared to the commercial banks. This puts issuers of CBDCs, central banks, in a massive conflict of interest. Central banks would be both the issuers of the currency, as well as a competitor to commercial banks, which means they would be more inclined to make decisions to serve the financial well-being of the central bank, rather than the economy.

The Best-Case Scenario(s)

Scenario A

With the pros and cons mentioned above, the best-case scenario would be a world where CBDCs and Fiat co-exist. The CBDCs would be equal in value to the fiat counterpart, with them being completely exchangeable at any time, with no transaction cost. Central banks would continue to issue and regulate both fiat and CBDCs, while banks provide intermediary services to end clients, either corporate, or retail, fiat or CBDC.

This solution would circumvent the conflict of interest mentioned earlier, while also not disrupting the banking system. This will also add a new line of digital services for existing banks, which would be considered a value-add for both investors and clients.

Scenario B

Another best-case scenario would be CBDCs having specific a use-case which is international banking. CBDCs would be used only for international transfers and foreign exchange transactions, which gets rid of long transaction times, high transaction fees, and the need for complicated nets of correspondent banks.

This also could be seen as a protection moat for your currency. In a way similar to RMB and CNY, the fiat currency will be for local use, and easily exchangeable to the digital currency, while the digital currency is used internationally only. This keeps international malicious actors from manipulating prices. Fiat currency purchasing power is maintained, while the CBDC floats, allowing for price fluctuations, without disrupting the local economy.

Impact on Policy

Precision in monetary and fiscal policy

CBDCS will provide central banks with a nuclear weapon for implementing monetary policy. Unlike physical cash, CBDCs can be tracked, monitored and adjusted in real time allowing central banks to implement infinitely more precise and timely monetary policy measures. Accurate, reliable, and up to date data will help you catch trends in overall economic activity, helping central banks move from being reactionary to proactive. Even when it comes to being reactive, this real time, accurate data will make sure a reaction is more effective in managing crisis in times of economic shock.

This also translates into a big quality of life improvement when it comes to taxation. One of the hardest parts of our calendar year is calculating your taxes (another reason to love Kuwait and its tax-freeness). Assuming a world where only CBDCs are used, tax calculation would be done automatically and with extreme precision, removing the need for tax accountants, tax calculation software, and the many headaches that come with them.

Final Words

Central Bank Digital Currencies represent a significant evolution in the world of finance and could have far-reaching implications for economies and societies. While the benefits of CBDCs are promising, addressing concerns related to privacy, financial stability, and cybersecurity is essential. The macroeconomic impact of CBDCs will depend on how effectively central banks manage their implementation and integration into existing monetary systems. As nations continue to explore the potential of CBDCs, a delicate balance between innovation and regulation will shape the future of currency and finance.