Emerging Market Bonds - Past, Present, and Future

DISCLAIMER: All views and ideas expressed on this site are my own and do not reflect the views of my employer, past, present or future. The information provided on this website is for general informational purposes only and is not intended to be taken as financial advice. Always consult a licensed financial advisor before making any financial decisions

In recent years, Emerging market (EM) bonds have become an increasingly popular place for investors, singular and institutions alike, to park their cash, but why?

Diversification

EM bonds have low correlation to developing market (DM) bonds, meaning they move independently of each other. While they might move together in a time of systematic pressure, this is not the case usually. If DM bonds are performing poorly, this does not necessarily mean that EM bonds will perform badly. This reduces portfolio risk and volatility, making it more appetizing for investors to add to their portfolios

Including EM bonds to fixed-income portfolios provide exposure to different economies growing at a significantly faster rate than their DM counterparts. Looking at current events, while DM economies are suffering from stubborn inflation, many EM countries are seeing revenue boosts due to elevated prices in commodities that they export, from energy, to metals, to food.

Diversification doesn’t just stop at country classification and geography, but currency diversification as well. Looking at 2022 alone, while having a strong start, the US dollar has had a very volatile year, seeing a downward slide against other currencies due to slowed global economic growth, elevated inflation rates. Investing in EM bonds, specifically local currency bonds, provides diversification benefits to a portfolio.

Higher Yields

On average, EM bonds provide higher yields than DM bonds. As per JP Morgan, US Dollar denominated EM bonds yield 8% on average, while local currency denominations yield around 7%. To compare this the 5Y US Treasury currently yields 4.1%, 5Y Euro area yields are around 3%, and UK 5Y GILTS are at 3.6%.

All this sounds great but, there is no free lunch, right? Issuers aren’t giving out higher yield because they’re feeling generous, as with everything, there is a risk involved, and these risks are a bit more elevated in the EM sphere.

Country-specific risk

Each country, developing, developed, or emerging has their own risks related to their own conditions. These conditions encompass many factors, but especially political, economic, and regulatory factors. Emerging market countries have higher country-specific risk than their DM counterparts. Quantifying risk is quite a challenge, but Aswath Damodaran’s Country Risk Premium is used industry-wide in valuations. Using these country risk premiums, we can see the difference in country-specific risk between DM and EM countries. Included below are regional averages of country risk premiums.

| Africa | 10.71% |

| Asia | 6.42% |

| Australia & New Zealand | 2.59% |

| Caribbean | 6.74% |

| Central & South America | 9.57% |

| Eastern Europe & Russia | 6.42% |

| Middle East | 5.68% |

| North America | 0.00% |

| Western Europe | 1.71% |

Currency Risk

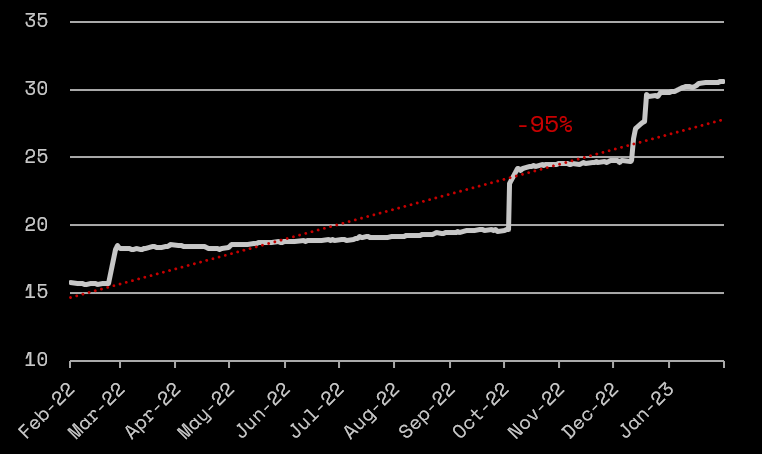

While non-hard currencies were mentioned earlier as a diversification factor, it is also a risk factor. Currency risk refers to the risk of an investment’s value or disbursements being affected by movements in the denominated currency, especially when an investor plans to convert it back to their local currency. Currency risk is especially prevalent in EM bonds, most recently witnessed in Egypt, an African EM country. Graph below summarizes the movements in EGP/USD in the last 12 months.

Let’s assume you bought into EGP denominated bonds in February 2022, what now? Well, your coupon payments, and principal repayment, are now worth 95% less when converted back to your local currency. That said, this is a fringe, extreme example used to show how bad it can be, and not indicative of the whole EM fixed-income sphere.

Liquidity Risk

Liquidity risk involves investors not being able to exit their investment easily and quickly, and without affecting the price of these sold securities. This risk is elevated in EM bonds as the markets which EM bonds are listed in are, well, less developed. There are also usually barriers of entry to the EM bond sphere, especially in local currency denominations, in which investors need to go through a third party, which will be too much of a hassle for many. All these factors limit the pool of investors, making liquidity a concern. That said, many EM bonds are listed in developing market exchanges, mainly Euronext where most hard-currency denominated EM bonds are listed.

Now that we know the pros and cons. Let’s look at what happened in recently within the EM fixed income sphere in the last few years

COVID

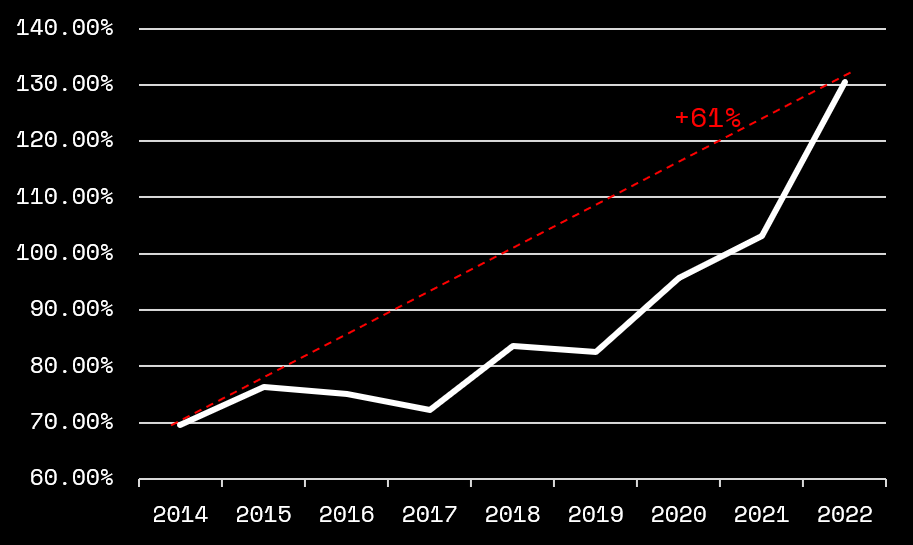

The COVID-19 pandemic had a massive impact on markets worldwide but sent EM markets into chaos. EM economies saw a significant contraction in GDP along with a rise in unemployment. As EM countries are mostly exporters of goods, supply chain disruptions played a big role in this contraction of GDP. This created some sovereign credit rating concerns for some more severely indebted countries. A case study for this should be Sri Lanka, who's debt/GDP was at 82.6% in 2019, which skyrocketed to 95.7% in 2020, reaching a whopping 130.5% in 2022 and now currently sitting at 114.3% in 2023.

Sri Lanka defaulted on it's debts in 2020 due to large trade deficits putting heavy downward pressure on foreign currency reserves. COVID-19 was the main culprit for this trade deficit as supply chains disruptions made it hard for the country to export, and caused a heavy decline in tourism.

That said, the silver lining is that this pandemic revealed hidden weaknesses in systems that governments were not aware of, and many took action, from digitalizing government services, to providing certain industries financial stimulus and applying economic reforms.

During this pandemic EM bonds saw in increase in volatility, and an unprecedented exit of hot money. As systematic risks increase, investors move their money into safe haven assets, especially US-Treasuries, the “safe’ benchmark used to calculate the spread in yield for all bonds. This massive sell off of EM bonds caused prices to crash, and yields to skyrocket. Though this is a problem for holders, it was a great opportunity for investors to enter the world of EM bonds.

Russian-Ukrainian War

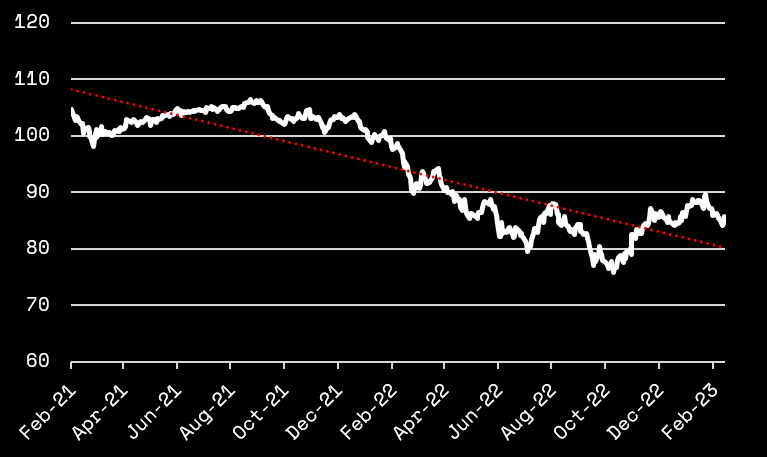

The Russian-Ukrainian war did not stop at increasing risks related to EM Bonds, but also sent EM Bond indices into a very weird position. Due to the sanctions package applied on Russia, corporate bonds and Russian government bonds defaulted due to them not having the ability to disburse required payments. This sent prices of Russian bonds crashing to never-seen-before lows. While this might seem Russia specific, Russia makes up a very big chunk of EM indices, on both equity and debt side, which sent EM indices into a massive slump as shown by the chart below

Ok, so we now know the pros, cons, and the recent history, but the real question is: What’s next?

China Reopening

China single-handedly is the largest emerging market country, and its economic recovery provides a boost to all economies worldwide as the main producer of goods. The reopening heals supply chain disruptions, increasing supply and demand for goods world wide. This is especially good news for energy-exporting EM countries that provide the energy needed to manufacture China’s goods.

China's disturbed real estate sector is expected to see a significant recovery within 2023. House sales were down 32%, along with 2.21bn Yuan worth of delinquent housing bonds, with a "worst case scenario" of a 350bn dollar loss within the banking and real estate sector, causing heavy downwards pressure on China's GDP. Many would think that China's real estate crisis would impact China alone but in a 2019 study by the US Fed, it was estimated that a 8.5% drop in China GDP, would cause a 6% drop in EM GDP's worldwide. A recovery in China's real estate sector, would provide a boost to Chinese GDP, which will domino into a GDP boost to EM economies as well.

Record setting start of the year

Developing and emerging markets have issued a record setting 39bn USD of USD and Euro denominated bonds since the start of this year to the 26th of January, to put this into perspective, this is 40% of all issuances in 2022. This demolishes the last record of 26bn raised in 2018.

Inflation - Buzz word of 2022

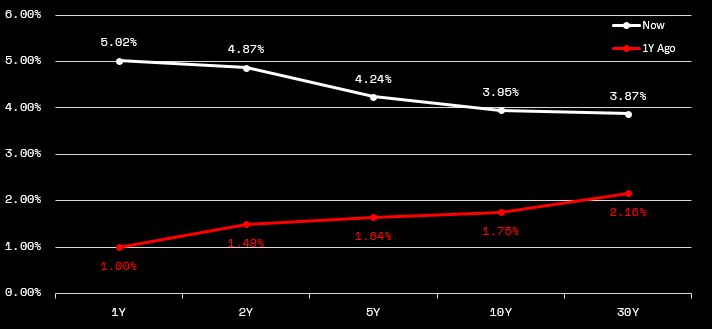

Through the Fed's hawkish perspective on taming inflation, interest rates have pushed US Treasury Bond yields to extremely high levels, along with an inversion in the yield curve. The inverted yield curve has been a reliable predictor of recessions, and US Yield curve being this inverted hasn't been since since the 1980s. These increased yields will see a hot money exit from emerging markets to US Treasury bonds which could result in weaker EM currencies.

The increase in interest rates is not only happening in the US, but worldwide. This increase in interest rates is making financing costs higher for indebted countries. This increases pressure on the budgets of these economies, which in turn makes them need to tap capital markets to cover the gap, but at higher financing costs. All this aside, as seen by the record issuances this year, higher costs doesn't seem to be stopping corporates and sovereigns alike from tapping the debt market.

Despite the risks, many investors are still drawn to the potential rewards that EM bonds can offer. Though volatile, the EM fixed-income market is in for an exciting 2023, with an overall positive outlook.